10 Advantages and Disadvantages of Mobile Money

Advertisement

Mobile money has revolutionized financial services, particularly in regions where access to traditional banking is limited. By using mobile devices, users can send, receive, and store money without needing a bank account, bringing financial inclusion to underserved communities. While mobile money offers new opportunities, it also presents potential challenges. In this guide, we’ll delve into the key advantages and disadvantages of mobile money, helping you understand its impact on modern finance and whether it suits your needs.

What is Mobile Money?

-

Mobile money is a broad term that encompasses various financial services delivered through mobile devices, especially in regions with limited traditional banking infrastructure.

-

It includes services like mobile payments, money transfers, and basic financial transactions, often provided by non-bank entities like mobile network operators (MNOs) and third-party mobile money service providers.

-

Mobile money services are particularly significant in regions where a large portion of the population is unbanked or underbanked, enabling them to access financial services without a traditional bank account.

-

Mobile money is essentially an electronic wallet service that allows users to store, send, and receive money using their mobile device, all under financial regulation.

-

A digital wallet is a virtual wallet that stores all contents in a digitized format, allowing for easy payments and other money-related transactions.

-

It can hold not only money but also coupons, loyalty points, value cards, and membership cards.

-

It supports financial services such as payments, transferring money, and paying for goods and services using a mobile device.

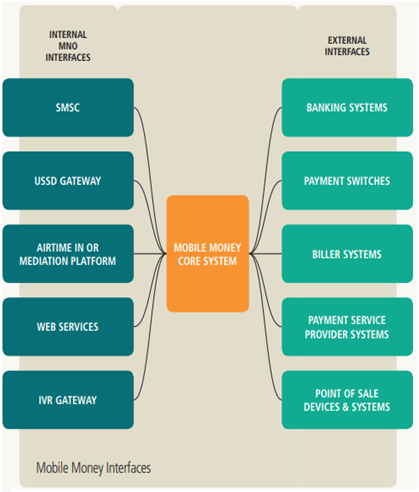

The figure-1 depicts mobile money interfaces. Mobile money model consists of banks, MNOs (Mobile Network Operators), Payment Gateway Providers, Payment Processing Agents, Payment platform Providers, Mobile subscribers and customers.

- Examples of mobile money solutions include Alepo, Obopay, DeeMoney, etc.

Mobile Money Examples: M-Pesa (Safaricom, Kenya), GCash (Globe Telecom, Philippines), Tigo Pesa (Tigo, Tanzania), Paytm (INDIA), PhonePe (INDIA), Google Pay (Tez) in INDIA, and more.

The system operates as a back-end-as-a-service model from a secure cloud, offering the following:

- Automated User and Merchant Onboarding

- E-wallets

- Card Payments acquiring and clearing for merchants

- Affiliates management

- E-shop Integration

- Payment Switch

- Closed and Open Loop Card Scheme management

- Mobile Money and Mobile banking

- Peer to peer loans

- Remittance Solutions

Advantages of Mobile Money

Here are some of the notable benefits of mobile money:

-

24/7 Availability: Mobile money is available 24/7, allowing money transfers anytime and anywhere, even without nearby banks. This significantly improves accessibility in rural areas.

-

Cashless Payments: It enables cashless payments, reducing dependence on physical cash and allowing tracking of transaction records. This enhances financial security and reduces risks associated with cash handling like loss, theft, or fraud.

-

Lower Transaction Costs: Mobile money offers lower transaction costs and improved security compared to credit cards.

-

Eliminates Middlemen: Customers no longer need middlemen for money transfers, which increases transparency.

-

Convenience: It reduces the need for physical visits to banks or payment centers, avoiding long travel and queues.

-

Easier Online Purchases: Purchasing online goods and services becomes easier, providing more options based on pricing and features.

-

Reaching Underserved Populations: Mobile money systems provide services to people who are geographically inaccessible or have very low incomes.

-

Accessibility via Basic Phones: Mobile money platforms can be accessed through basic mobile phones with low transaction costs.

-

Extensive Agent Networks: They are distributed by vast networks of agents, providing person-to-person contact and training to those unfamiliar with the technology.

-

Financial Inclusion: Mobile money services can reach unbanked and underbanked populations, offering access to financial services they might otherwise lack.

-

Enhanced Security: Transactions are typically secured with PINs, passwords, and encryption, enhancing the security of financial transactions.

-

Rapid Transactions: Transactions are processed quickly, enabling rapid money transfers and bill payments.

-

Financial Planning: Users can easily track transactions and account balances, aiding in budgeting and financial planning.

Disadvantages of Mobile Money

Following are some of the drawbacks of mobile money.

-

Bank Compliance: Customers might need to obtain compliance from banks, which can be restrictive for businesses or large transactions.

-

Lack of Interoperability: Lack of interoperability between networks limits reach and makes transactions cumbersome. Service interruptions on mobile networks can also disrupt transactions.

-

Multi-Party Involvement: Adoption requires multi-party involvement (e.g., agents, governments, corporations), and trust between these parties is essential for a successful platform.

-

Illiteracy: Reducing ignorance and illiteracy is necessary for wider acceptance of the system.

-

App Requirements: It requires an app to be installed, which may not be available on all mobile phones, requiring smartphones.

-

Susceptibility to Fraud: Mobile money services can be susceptible to fraud, such as phishing attacks or unauthorized transactions.

-

Transaction Limits: Transaction limits can be restrictive for businesses or large transactions.

-

Privacy Concerns: Users may have privacy concerns regarding their financial data and transactions.

-

Risk of Loss/Theft: If a user’s phone is lost or stolen, their mobile money account could be at risk without proper security measures.

-

Limited Acceptance: Mobile money services may not be accepted everywhere, limiting their usability in certain situations.

Conclusion : Mobile money provides unprecedented access to financial services for many, bridging gaps left by traditional banking. While it offers clear advantages like convenience and accessibility, users must also consider disadvantages like security risks and dependency on technology. Understanding these pros and cons allows for more informed choices, ensuring you can leverage mobile money’s benefits while staying aware of potential drawbacks.

Advertisement

RF

RF